This article was first published on Pursuit. Read the original article. by Associate Professor Jongsay Yong, Dr Ou Yang , Professor Anthony Scott and Professor Yuting Zhang In Australia, competition and consumer choice have been key components in aged care reforms since the 2011 Productivity Commission Report.

On 26 June 2013, the Australian government passed the Aged Care (Living Longer Living Better) Act. The aims were to deliver more support and care at home, to allow more consumer choice and greater control and to provide greater recognition of diversity and support to carers.

Under the umbrella of this Act, the government has, in recent years, implemented a series of market-oriented reforms aiming to promote consumer choice and competition in the sector.

Through these reforms, the government intends to increase competition in the market. How these reforms influence aged care quality and prices remain unclear.

MARKET FAILURES IN AGED CARE

Our research examined how competition among aged care providers is associated with quality of care and prices in the sector.

We used a comprehensive set of de-identified data on quality of care, prices and residential aged care facility characteristics provided by the Royal Commission into Aged Care Quality and Safety from the years 2008-09, 2013-14 to 2019-20.

The dataset covers around 2,900 facilities each year, comprising nearly all facilities in Australia.

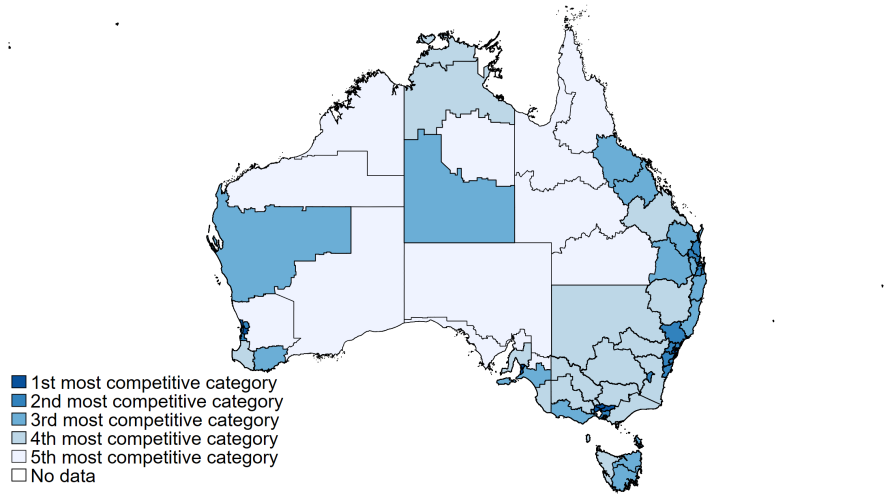

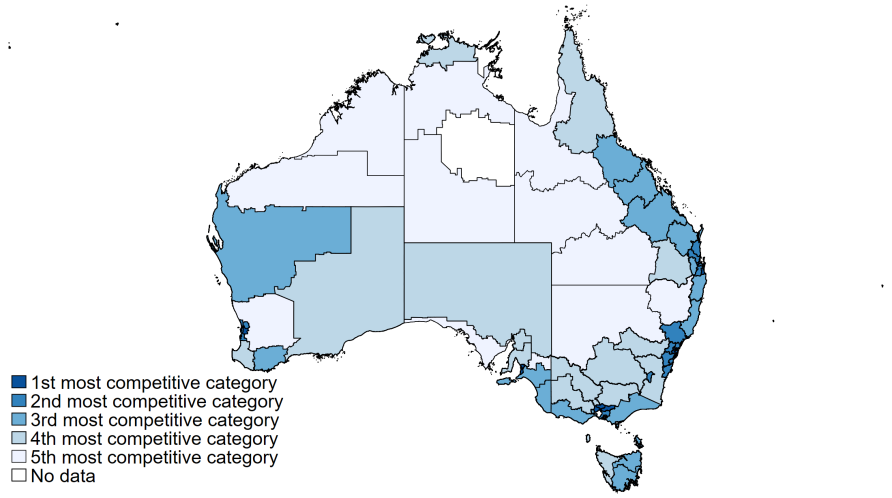

We used three different measures of competition: number of competitors within a 10 km radius; distance (in km) to the third-closest competing facility; and an index based on market shares known as the Herfindahl-Hirschman index (HHI).

The HHI is a measure of the size of providers in relation to the industry and an indicator of the amount of competition among them.

We then examined how these competition measures were associated with six quality indicators covering different quality domains: antipsychotic use, premature mortality, reported assaults, number of complaints, and staffing hours (total care hours and registered nurse hours per resident per day), and established whether competition was related to the average price consumers pay to providers.

Key Insights

Although the competition in regional areas on average has slightly increased from 2008-09 to 2018-19, after years of market-oriented reforms, we found that in major cities competition has decreased because markets have become dominated by larger providers.

Our regression estimates indicate that more competition is not associated with better quality of care or lower prices. This result holds for all quality measures we examined, regardless of which competition measure we used. This clearly indicates that markets have failed to function in the aged care sector.

Three reasons may explain this. Firstly, market failures occur when market mechanisms don’t result in an efficient allocation of resources and better outcomes. We want competition to encourage providers to innovate, be more efficient, and deliver better quality services at a lower price.

For this to happen, there must be transparent information about quality and prices so residents and their families can choose the highest quality and value for money providers. Neither is true for the residential aged care sector in Australia.

Secondly, aged care residents and their families find it difficult to choose a provider, and this could be the case even if they had better information. Informed consumer choice is a challenge. Residents themselves most often rely on family members who need to choose a facility very quickly so there is little time to search extensively and gather trusted information.

Supply of residential care places is restricted by the government through a process known as the Aged Care Approvals Round (ACAR), which places limits on both the number of places and the locations where they can be offered. This helps to control the overall costs but may also reduces the alternatives available and prevents new entrants into the market.

And lastly, there is an increase in the number of large and dominant providers in the residential care industry that has further reduced competition and choice. The share of very large providers (with more than 5000 beds) has risen steadily from 16 per cent in 2009-10 to 39 per cent in 2018-19.

Our study indicates that the average number of facilities owned by one provider has increased 14 per cent between 2014-15 and 2018-19. Increasing concentration reduces the alternatives available to consumers, reducing competition, choice and potentially reducing quality and increasing cost.

The Aged Care Royal Commission has called for increased funding in their final report, but more money doesn’t by itself solve the aged care problem. As shown in our research, the sector hasn’t performed despite years of market-oriented reforms.

ADDRESSING AGED CARE MARKET FAILURES

We need to re-organise the market to ensure that resources are properly and efficiently allocated in the sector. Policies should focus on addressing sources of market failures to improve choice and information, while also using new funding models and more carefully regulating residential aged care providers.

First, a system of public rating and reporting of quality of care aiming at facilitating consumer choice is urgently needed in the residential aged care sector. This is in line with the Royal Commission’s report (Recommendation 24).

Second, price transparency, or the lack of it, is another source of market failure that requires policy actions. The current pricing structure should be simplified so that consumers can compare products and services from different providers with reasonable ease, for example via a comparison website.

While the Royal Commission recommends an independent pricing authority (Recommendation 6), there is no mention of simplifying the pricing structure in aged care. Price transparency is a crucial component of reforms for market forces to function.

The policy focus on consumer choice is important, but if consumers aren’t able to drive competition given the difficulties of implementing informed consumer choice, then more government regulation is required to drive quality up and drive prices down.

If markets fail, which they clearly have, then governments need to step in to act on behalf of aged care residents. This could include a system of pay for performance for providers, that links funding to the quality of care provided.

Third, consumers need an advocate to be on their side in their bargaining with providers. The advocate must be independent and have no vested interest in the transaction. The advocate should have an understanding of the needs and preferences of the consumer, and services provided in the local area.

The setting up of advocacy services is also a recommendation made by the Royal Commission (Recommendation 106), although we think the advocacy role could be integrated into the current home care services.

Given that most consumers transition from home care to residential care, this will provide an integrated pathway for consumers as their needs change.

This study was supported by the National Health and Medical Research Council (NHMRC) Partnership Centre for Health System Sustainability (grant ID: 9100002) and partly supported by the Centre of Excellence in Population Ageing Research, Australian Research Council. (CE170100005). The funders had no role in study design, data collection and analysis, decision to publish, or preparation of the manuscript. We are grateful to the Royal Commission into Aged Care Quality and Safety for providing the data.

Featured